tax avoidance vs tax evasion south africa

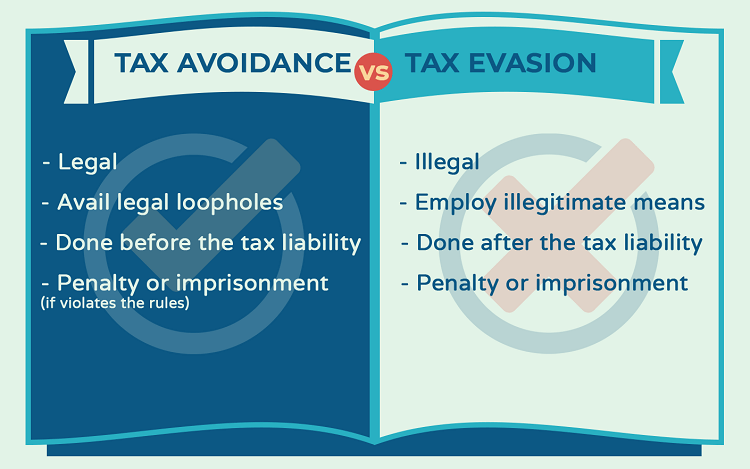

One is legal and one isnt be sure to know the difference or your company could pay the ultimate. There is not so much of a fine line between tax evasion.

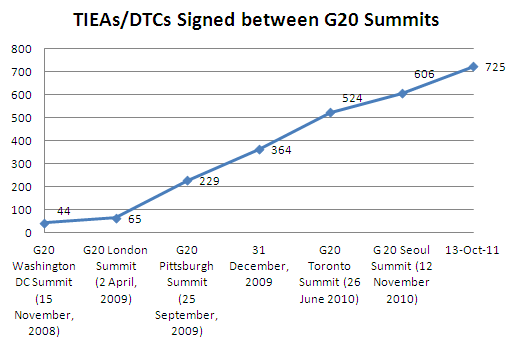

Tax Evasion Statistics 2022 Update Balancing Everything

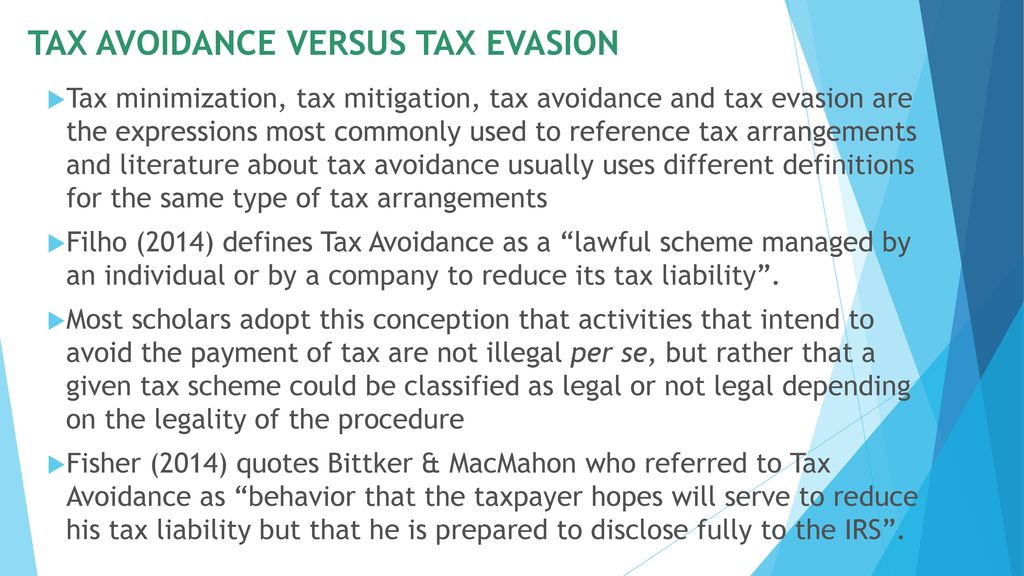

De Vos the difference between tax avoidance and tax evasion tax january 30 2015 admin tax avoidance is generally the legal exploitation of the tax regime to.

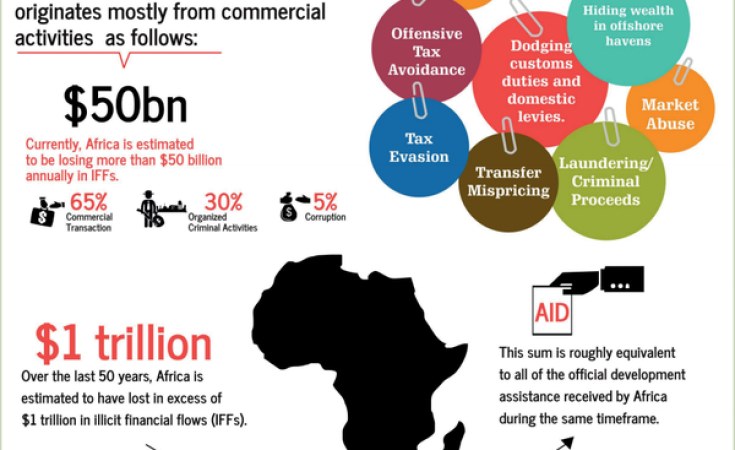

. Tax avoidance may be considered as either the amoral dodging of ones duties to society part of a strategy of not supporting violent government activities or just the right of every citizen to find all the legal ways to avoid paying too much tax. Recent waves of tax dodging scandals including those of tax. Taxpayers intentionally falsifying or concealing the true condition of their activities to.

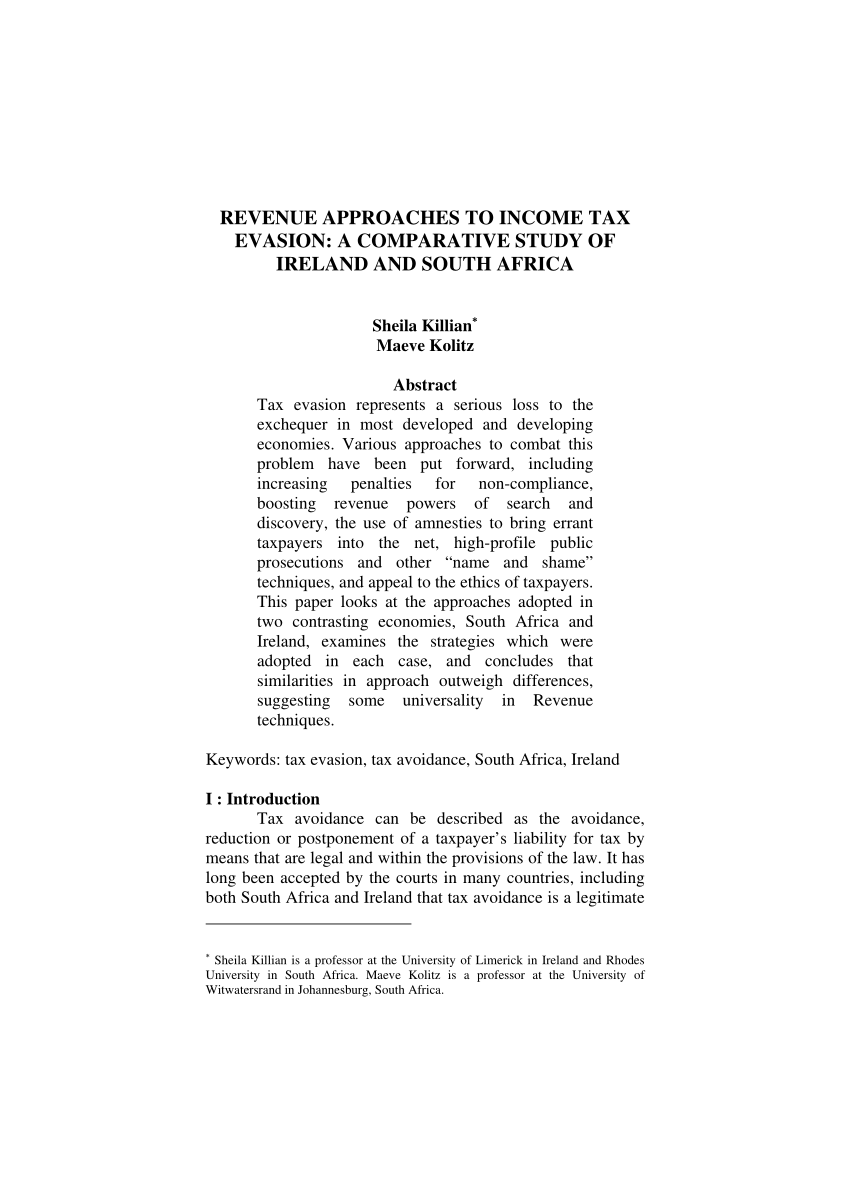

The South African Revenue Services SARS crackdown on non-compliant taxpayers in recent months is well documented. The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. Posted May 23 2019 by Jono.

Tax avoidance understood as the use of the so-called loopholes in the tax legislation to reduce ones tax payments increasingly tops news charts. Tax avoidance may be considered as either the amoral dodging of ones duties to society part of a strategy of not supporting violent government activities or just the right of every citizen to find all the legal ways to avoid paying too much tax. Businesses avoid taxes by taking all legitimate deductions and by sheltering income from taxes by setting up employee retirement plans and other means all legal and under the Internal Revenue Code or.

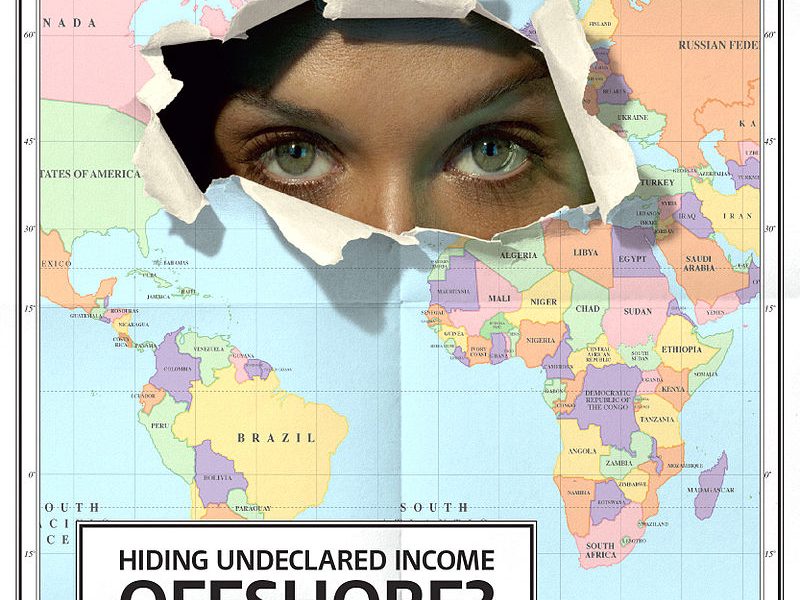

There is not so much of a fine line between tax evasion and tax planning as there is a giant grey superhighway dissecting the two named tax avoidance says Mark Diuga regional wealth manager in Cape Town at Overberg Asset Management. The recent EUs blacklist of 17 tax havens Paradise Papers and last years Panama Papers are among the starkest examples. This guide provides a comprehensive analysis of the issue of tax and wage evasion in South Africa.

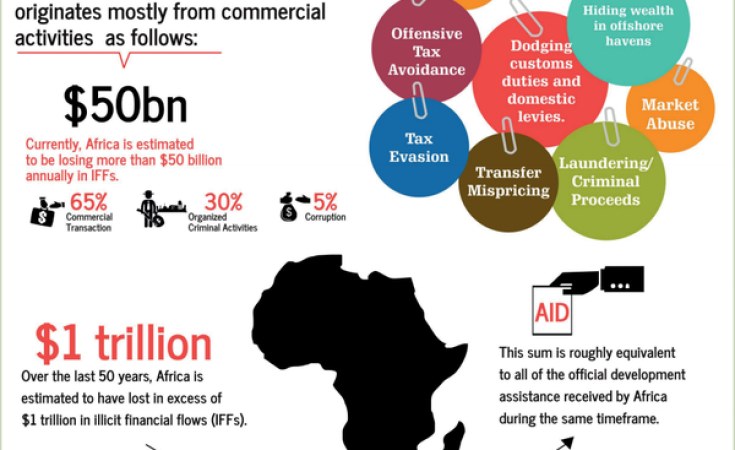

The Tax Network estimates that global corporate tax abuse costs the world 245-billion in lost corporate tax a year. Tax Evasion is illegal. Tax avoidance understood as the use of the so-called loopholes in the tax legislation to reduce ones tax payments increasingly tops news charts.

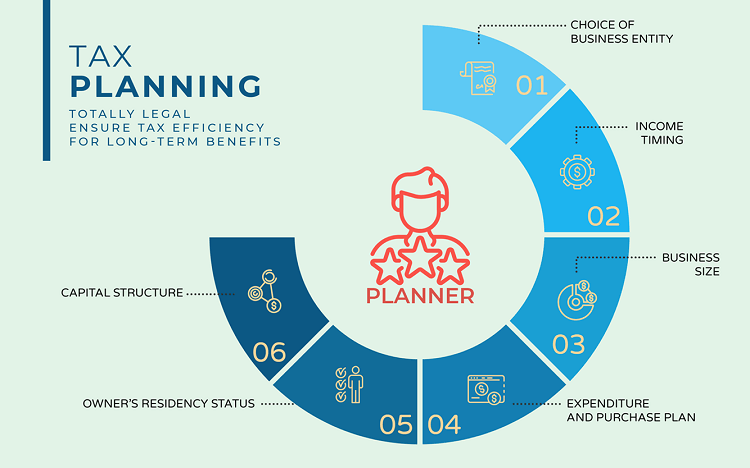

It is reasonable to presume that anyone would want to pay less tax and therefore it is legal to implement ways in which to do so by use of mechanisms available under present laws and regulations. Businesses get into trouble with the IRS when they intentionally evade taxes. Tax evasion on the other hand is a crime in almost all countries and subjects the guilty party.

First tax avoidance or evasion occurs across the tax spectrum and is not peculiar to any tax type such as import taxes stamp duties VAT PAYE and income tax. Tax evasion often involves. While tax evasion requires the use of illegal methods to avoid paying proper taxes tax avoidance uses legal means to.

Tax avoidance is generally the legal exploitation of the tax regime to ones own advantage to attempt to reduce the amount of tax that is payable by means that are within the law whilst making a full disclosure of the material information to the tax authorities. The principle of evading payment of taxes by use of illegal means is to be frowned. Tax Avoidance is legal.

Legal Aspects of Tax Avoidance and Tax Evasion Two general points can be made about tax avoidance and evasion. Tax avoidance is the legitimate minimizing of taxes using methods included in the tax code. Avoidance vs evasion.

SOUTH AFRICATax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share 15 September 2021 News 131 Fares RAHAHLIA News 131 Fares RAHAHLIA. Tax evasion on the other hand refers to efforts by people businesses trusts and. Staff Writer 14 September 2021.

There is no prohibition on minimising your tax payable in South African tax law however theres a fine line between tax avoidance and tax evasion with severe consequences for those who dare cross it. Tax Avoidance vs Tax Evasion. But your business can avoid paying taxes and your tax preparer can help you do that.

Tax evasion on the other hand is a crime in almost all countries and subjects the guilty party. Classifying a transaction as an impermissible tax avoidance arrangement does not automatically equate to tax evasion. Measures improving the ability to.

Race Institutional Culture and Transformation at South African Higher Education Institutions South African Constitutional Law in Context Współczesna endodoncja w praktyce. Secondly legislation that addresses avoidance or evasion must necessarily. Not only does it build on already existing materials and studies to.

Numbers from South Africa are difficult to come by but the SA Tied Network has. Financial decisions are wrapped up in. Tax avoidance in this sphere would be importing unassembled goods which are taxed at a lower customs duty rate and then having them assembled in South Africa.

Tax avoidance is completely legal and is seen as a way in which a taxpayer can protect his or her property from unnecessary taxes. When considering Value Added Taxes evasion on such would be deliberately understating sales or overstating expenses. Tax Avoidance Differences between Tax Avoidance and Tax Evasion.

Tax Avoidance is legal. Tax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share. SOUTH AFRICATax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share 15 September 2021 News 154 Fares RAHAHLIA News 154 Fares RAHAHLIA.

Tax avoidance on the other hand refers to a situation where the taxpayer arranges his or her affairs in a completely legal and lawful way that results in a reduced income or has no income on which tax is payable. Paying corporate tax in South Africa in 2020 is not for the faint of heart. Other entities to avoid paying taxes in unlawful ways.

The taxman in order to decrease their tax burden and involves in specific false tax. Avoidance would be making use of all the available provisions in the. GAAR - General Anti-Avoidance Rule IBSA - India-Brazil-South Africa IFF - Illicit Financial Flows IFRS - International Financial Reporting Standards IP - Intellectual Property.

Basically tax avoidance is legal while tax evasion is not. For someone to be found guilty of tax evasion there must have been an unlawful intention to wilfully deceive SARS by means of fraud or deceit either by misstating figures or entering into simulated sham transactions.

Tax Avoidance Vs Tax Evasion Infographic Fincor

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Pdf Revenue Approaches To Income Tax Evasion A Comparative Study Of Ireland And South Africa

The Role Of Parliament In Reducing Tax Evasion And Avoidance Ppt Download

Guest Blog Tax Avoidance And Evasion In Africa Tax Justice Network

Tackle Tax Evasion To Fuel Africa S Development

Africa Un Must Fight Tax Evasion Says Un Expert Allafrica Com

Tax Avoidance Vs Tax Evasion Understand The Difference Youtube

Cross Border Tax Avoidance And Evasion A Developing Asia Perspective International Tax Review

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Why It S Time To Talk About Corporate Tax Schroders Global Schroders

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

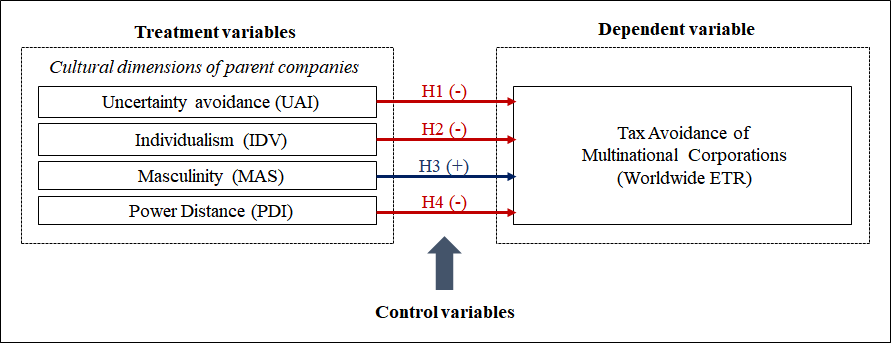

Sustainability Free Full Text National Culture And Tax Avoidance Of Multinational Corporations Html